With an increasing number of organisations turning to advisory boards to provide an objective view of their business, we run through some of their roles and responsibilities and outline the pros and cons of assembling one.

No matter how strong your company’s C-suite is, there are times in the evolution of a business when it is prudent to seek help. The most effective way to do this in, our opinion, is through an advisory board.

At ORESA, we’ve found that an increasing number of organisations are appointing advisory boards, for a variety of reasons. These range from doing business in diverse global markets to embracing regulatory change or helping with managing human resources. While advisory boards are obviously no substitute for the classic statutory board, a well-appointed group of experts can offer a clear, objective view of the challenges faced and provide timely solutions, knowledge and contacts. They are not beholden to any governance authority, statutory responsibilities or regular meetings holding it back or slowing it down.

Advisory board’s responsibilities

- developing an understanding of the business, market and industry trends

- provide “wise counsel” on issues raised by owners/directors or management

- provide unbiased insights and ideas from a third point-of-view (not involved in the operation of the business)

- encourage and support the exploration of new business ideas

- act as a resource for executives

- provide social networking platform for directors and the company

- encourage the development of a governance framework that enable sustainable growth of the company

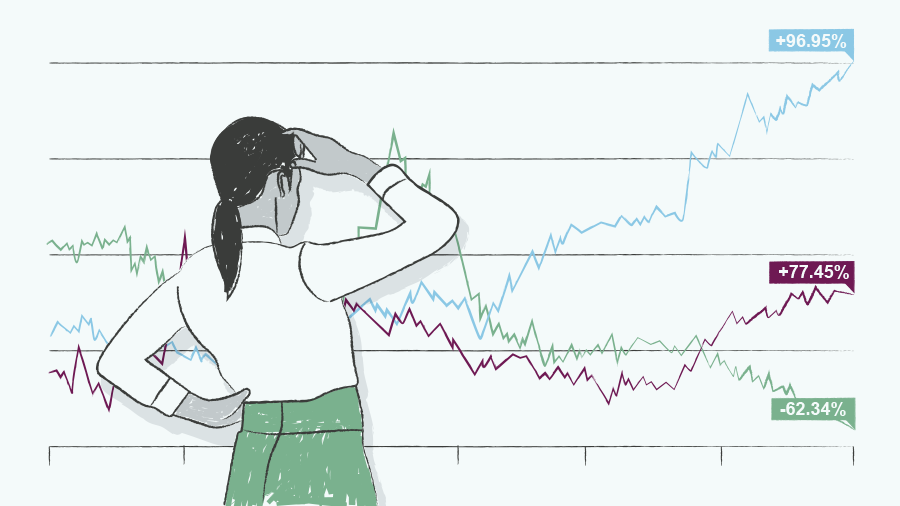

- monitor business performance

- impose challenges to directors and management that could improve the business

For entrepreneurs and private companies in their early years, advisory boards can offer vital experience without the founder needing to dilute ownership of the firm or cede control. Smaller advisory boards also have the benefit of being more flexible than the traditional board of directors, given that their sole purpose is to focus on a particular problem and not the minutiae of the rest of the business. Alternatively, the advisory board could have a broad remit, while the leaders in the company focus on specific challenges, although this arrangement is rare. Typically, advisors will be used to guide a business owner through specific operational issues.

Selecting an Advisory Board

As you can see, there’s only an upside in recruiting an advisory board. Well, that’s not quite right. Advisory boards may well be excellent resources but they work well only if you select them well. Even then, some things just don’t work out. To make the most out of them, a firm needs to be very clear about why it is appointing the board and what it expects the board to achieve. Clarity and outlined objectives from the beginning will minimise disappointment and frustration in the long run.

These objectives need to be clear before one selects potential advisory board members so as to figure out the best people to approach. Who and where to find them can be difficult depending on your contacts book and networking abilities. Generally speaking (and dependent upon the purpose of the board), it is useful to select four to six people with diverse business backgrounds. Pedigree is obviously important but one should also consider the chemistry of the group.

How often do you meet with the board?

Then there are the technical details such as how often to meet. Typically, advisory boards meet twice or three times a year. Any more than that defeats the purpose of the board and will probably be unnecessary. They are there to help young businesses navigate the big issues and needn’t be briefed with quarterly updates.

Do you pay an Advisory Board?

The question of remuneration is one that I’m often asked in relation to advisory boards. In my experience, senior and retired executives are generally very forthcoming with free advice and most enjoy the process of transferring knowledge and experience to younger entrepreneurial types. Paying for lunch every time you meet might be gesture enough, but offering stock options, however small, shows that you take their input seriously and will make for a better professional relationship.

In the next part of this series I’ll look into how to get the most out of an advisory board. For advice on selecting board members or to just enquire about how ORESA can help your business with top level personnel, email [email protected].